When goods are exported outside India the tax is known as export custom duty. However It just so happens that I was moving in 2 days and was in one of the groups required to show.

Pdf Property Transfer Tax And Stamp Duty

Taxes and subsidies change the price of goods and as a result the quantity consumed.

. Notification that a company is in liquidation. B Numbering 1 FAR provisions and clauses. Executed on the basis of decree or final order of any Civil Court or every order made by the Tribunal under section 394 of the Companies Act 1956 as defined by section 210 not being a transfer charged or exempted under No.

Now While I have no qualms about doing my civic duty there was just no way I was going to be able to fulfill that duty. When goods are imported from outside the tax known as import custom duty. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5.

Deemed consideration under section 24 of the Stamp Duty Ordinance Cap117. Information as to pending liquidations and disposal of unclaimed assets. As mentioned above we can deduct the exemption waiver.

62 on the market value of the property which is the subject matter of the conveyance when. Enforcement of duty of liquidator to make returns etc. Net Chargeable Gain Chargeable Gain - Exemption Waiver RM10000 or 10 of Chargeable Gain whichever is higher RM190000 - RM190000 X 10 RM171000.

There is a difference between an Ad valorem tax and a specific tax or subsidy in the way it is applied to the price of the good. A debt written or signed by or on behalf of a debtor in order to supply evidence of such debt in any book other than a bankers pass book or on a separate piece of paper when such book or paper is left in the creditors possession and the amount or value of such debt-. Custom Duty is an indirect tax levied on import or export of goods in and out of country.

Subpart 522 sets forth the text of all FAR provisions and clauses each in its own separate subsection. Books of company to be evidence. The compounded Stamp Duty payments should be credited to the Stamp Duty account No.

Exemption from stamp duty. Description of Instrument. Ad Valorem Stamp Duty.

Whether the stamp is required for amounts received only in cash or also for receipts through a cheque etc. Rate of Stamp Duty. The tax collected by Central Board of Indirect Taxes and Customs.

Deemed sale and purchase under section 191E of the Stamp Duty Ordinance Cap117. In the end levying a tax moves the market to a new equilibrium where the price of a good paid by buyers increases and the proportion of the price received by sellers decreases. Whether the stamp is required on receipt for Rs 500 also or it is only for amounts exceeding Rs 500 and upto which value.

In February 2020 as part of Indias. Now we move on to the net chargeable gain. For what its worth I can tell from the comments that most people dont agree with a damn bit of it.

Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104. Disposal of books etc of company. 4153842 of Commissioner General of Inland Revenue at Bank of Ceylon Taprobane Branch Use system printed pay-in- slips that have been issued by Inland Revenue Department for each quarter to settle the Stamp Duty liability of that quarter.

I solicit your expert advice on the levy of tax in the shape of a one-rupee revenue stamp. The charterparty between the petitioner and respondent is unstamped and when it is presented before the officer who is authorised to receive the document in evidence unless it is impounded collecting stamp duty and penalty under Section 35 of the Indian Stamp Act 1899 the same is inadmissible thereby the order dated 28012022 passed by.

Stamp Duty Malaysia 2022 Commonly Asked Questions Malaysia Housing Loan

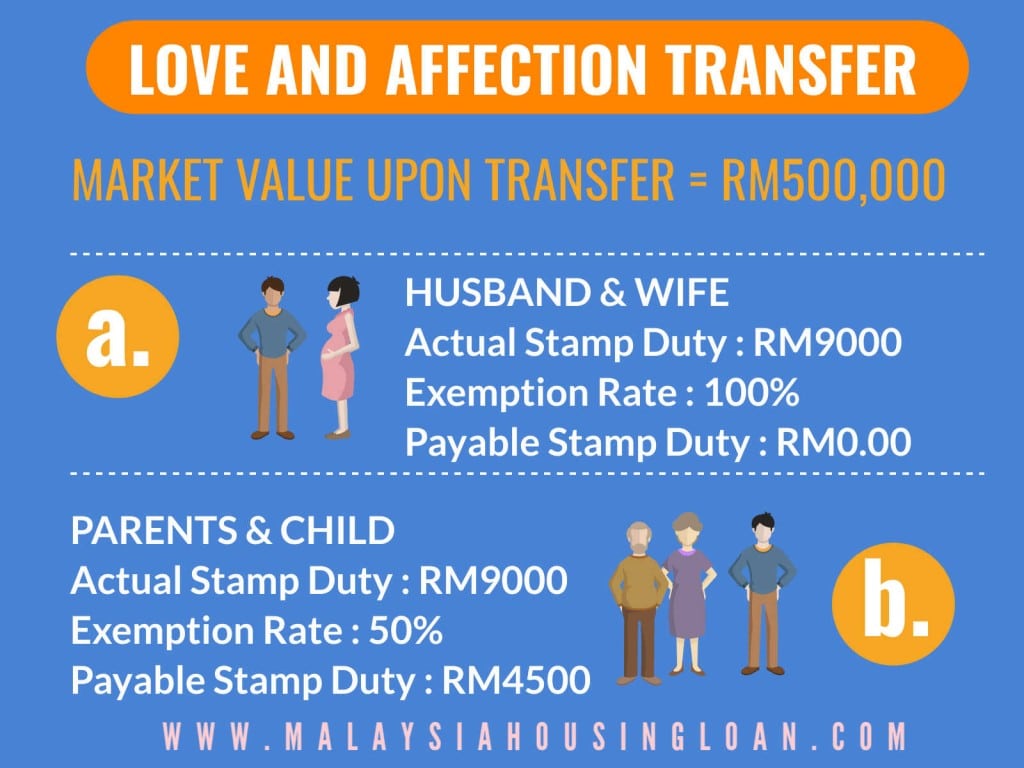

Love And Affection Transfer Malaysia 2022 Malaysia Housing Loan

Stamp Duty Exemption In Malaysia Jr Ng Chin Jc Law

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Stamp Duty For Transfer Of Properties In Malaysia

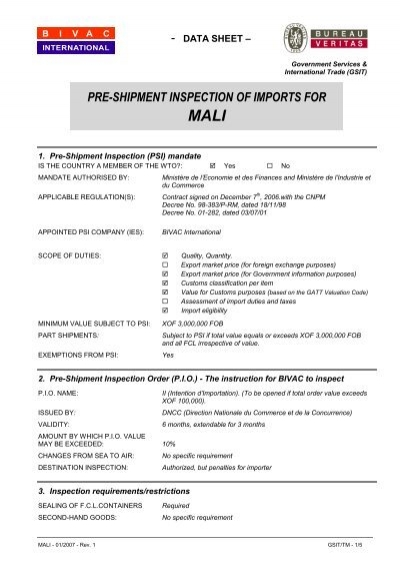

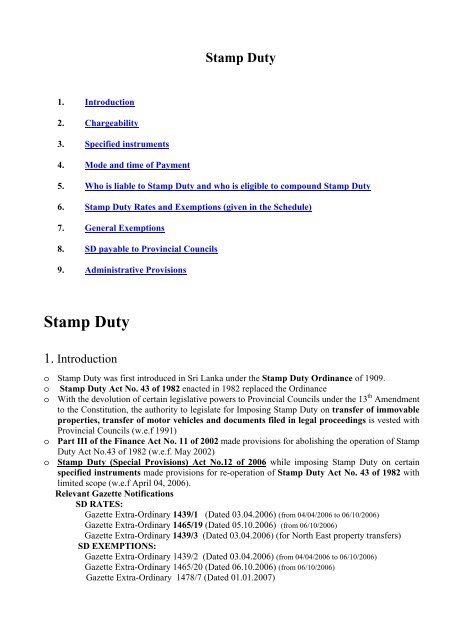

Stamp Duty Sri Lanka Inland Revenue Department Website

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Stamp Duty Exemption In Malaysia Jr Ng Chin Jc Law

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Love And Affection Transfer Malaysia 2022 Malaysia Housing Loan

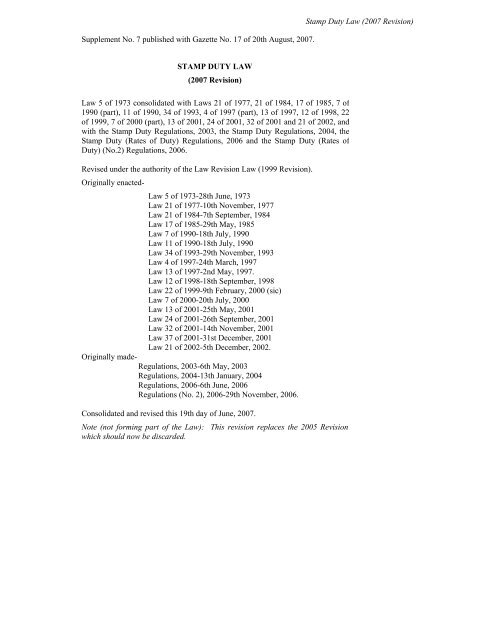

Stamp Duty Law 2007 Revision Cayman Islands Land Amp Survey

Love And Affection Transfer Malaysia 2022 Malaysia Housing Loan

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Stamp Duty Malaysia 2022 Commonly Asked Questions Malaysia Housing Loan

Pw Tan Associates Photos Facebook